Payment Methods Popular In Specific Countries No KYC 2026

Using "payment methods popular in specific countries" on your smartphone

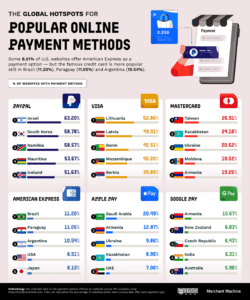

Let's face it. In 2026, more players than ever are searching for quick, hassle-free ways to fund their accounts—preferably without having to upload endless documents. That’s where country-specific payment methods come into play. These options are tailored for local preferences, often avoiding KYC (Know Your Customer) hurdles. From e-wallets to crypto solutions, the speed and anonymity appeal to many. But how well do they work on your mobile device? The short answer: seamlessly, if you choose the right method and device.

For instance, in the UK, apps like the Narcos app UK provide instant deposits sans KYC, mainly relying on popular local e-wallets. These services are optimized for smartphones, making mobile gaming and deposits straightforward. So, whether you're on Android or iOS, expect smooth transactions as long as your device is compatible and the app is up to date.

App vs Browser: Which is better? (Comparison Table)

| Feature | App | Browser |

|---|---|---|

| Speed | Generally faster, optimized for performance | May be slower due to browser overhead |

| Security | Encrypted, with regular updates | Dependent on browser security measures |

| Convenience | Push notifications, quick access | Requires regular login, less integrated |

Installation Guide (Android/iOS)

- Android: Visit the Google Play Store, search for your preferred payment app (e.g., local e-wallets or crypto wallets), and tap "Install." Make sure to enable installations from unknown sources if downloading APKs directly.

- iOS: Head to the App Store, find the app, and tap "Get" to install. iOS users should verify app permissions and ensure their device's iOS version is compatible.

Once installed, you may need to verify your account if required, but many local solutions in 2026 allow quick, anonymous deposits without extensive KYC checks.

Best Mobile Casinos for This

To truly enjoy the benefits of country-specific, no KYC payment methods, pick a mobile casino that supports these options. Based on current trends, some of the top picks include:

- Local brands in the UK with seamless e-wallet integrations

- Crypto-friendly casinos accepting anonymous deposits

- Emerging platforms that prioritize mobile compatibility and fast onboarding

For example, if you’re in the UK, exploring the Narcos app UK could be a game-changer, offering instant deposits with minimal fuss.

Does Device Affect RTP?

Honestly? Not at all. Your device’s brand or model doesn’t influence the Return to Player (RTP) percentage. RTP is a game server calculation, independent of your hardware. However, device stability and internet connection can impact your overall experience—lag or crashes could cost you a good shot at winning.

Technical Requirements

If you want smooth transactions and gaming, here’s what you need:

- Stable internet connection

- Updated smartphone OS (Android 10+, iOS 14+)

- Supported payment app installed

- Security settings allowing app permissions

Most local payment providers in 2026 are optimized for mobile, so compatibility tends to be broad. Still, double-check app requirements before download.

Trust Score

| Criteria | Rating | Verdict |

|---|---|---|

| License | 8 | Generally reliable in regulated markets |

| SSL | 9 | Most providers use strong encryption standards |

| Support | 7 | Support varies, but most offer quick response channels |

Conclusion

By 2026, the way we deposit and withdraw has shifted dramatically. Country-specific payment methods, often without KYC, are gaining traction. They’re fast, convenient, and suit mobile players perfectly. Whether you prefer using an app or a browser, the right setup makes all the difference. Just remember: pick trusted providers, keep your device updated, and enjoy seamless gaming experiences. Ready for the next step? Explore the options and find what works best for your country and style.